When it comes to securing your family’s future, life insurance plays a crucial role. Among the many providers available, Gerber Life Insurance stands out as a reliable and trusted name. Known for its affordable plans and policies designed to meet the needs of families, Gerber Life has been helping people achieve financial security for decades. In this article, we will explore what Gerber Life Insurance offers, its benefits, and why it might be the right choice for you.

What is Gerber Life Insurance?

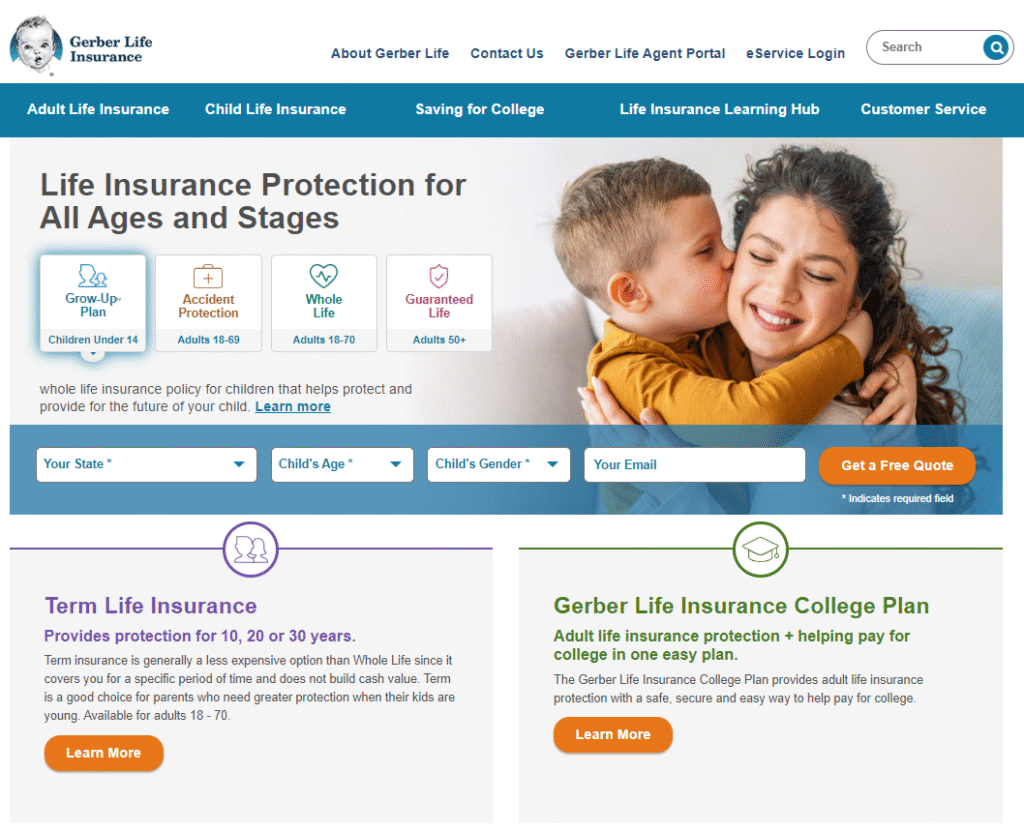

Gerber Life Insurance is a well-known life insurance company that primarily focuses on families, parents, and children. The company offers a range of life insurance products that aim to provide financial stability and peace of mind for policyholders. With Gerber Life, you can choose from different plans such as Whole Life Insurance, Term Life Insurance, and Guaranteed Life Insurance depending on your personal needs.

One of the most popular offerings from Gerber Life is the Grow-Up® Plan, which is designed specifically for children. This plan provides lifetime coverage and builds cash value over time, making it an excellent option for parents who want to secure their child’s financial future.

Types of Gerber Life Insurance Policies

Gerber Life Insurance offers several types of policies to cater to different situations. Let’s take a closer look at some of the most popular ones:

1. Gerber Life Grow-Up® Plan

This is a whole life insurance policy for children that starts from the age of 14 days up to 14 years. The unique feature of this plan is that the coverage automatically doubles when the child turns 18, at no extra cost. Additionally, it builds cash value over time, which can be borrowed against in the future.

2. Gerber Life Term Life Insurance

Term life insurance from Gerber Life provides affordable coverage for a specific period, usually ranging from 10 to 30 years. It is a great option for families who need temporary protection, such as while paying off a mortgage or raising young children.

3. Gerber Life Whole Life Insurance

Whole life insurance provides permanent coverage with fixed premiums that never increase. This policy also accumulates cash value over time, making it a useful financial asset.

4. Gerber Life Guaranteed Life Insurance

This plan is designed for adults aged 50 to 80 who may have trouble qualifying for traditional life insurance due to health concerns. The policy guarantees acceptance without a medical exam, offering peace of mind for seniors.

Benefits of Choosing Gerber Life Insurance

There are several advantages to selecting Gerber Life Insurance as your provider:

-

Affordability: Gerber Life is known for offering competitive rates that fit into most family budgets.

-

Flexible Options: With different plans available, you can choose the policy that best suits your needs.

-

Cash Value Growth: Many Gerber Life policies build cash value over time, providing a financial cushion for emergencies.

-

Trusted Brand: Gerber Life has been a trusted name for decades, giving customers confidence in their services.

How Does Gerber Life Insurance Work?

The process of obtaining a Gerber Life Insurance policy is simple and straightforward. You can apply online or over the phone, and in many cases, you don’t need a medical exam, especially for child and guaranteed life plans. After selecting your desired plan, you’ll choose your coverage amount and pay your premiums monthly or annually.

Once your policy is active, your beneficiaries will receive the death benefit in case of your passing, ensuring they have the financial support they need during difficult times.

Who Should Consider Gerber Life Insurance?

Gerber Life Insurance is an excellent choice for:

-

Parents: Looking to secure their child’s future with a whole life policy.

-

Families: Who want affordable term life coverage during critical years.

-

Seniors: Needing guaranteed acceptance life insurance without health exams.

If you value reliability, flexibility, and affordability, Gerber Life Insurance is worth considering.

Frequently Asked Questions About Gerber Life Insurance

1. Is Gerber Life Insurance reliable?

Yes, Gerber Life has a long-standing reputation and is backed by strong financial ratings, making it a dependable option for life insurance coverage.

2. Can I cancel my Gerber Life policy?

Yes, you can cancel your policy anytime. However, depending on your policy type, there may be certain conditions or cash value implications.

3. Does Gerber Life require a medical exam?

For many policies, especially for children and guaranteed life plans, no medical exam is required.

Final Thoughts

Choosing the right life insurance policy is an important decision that can impact your family’s financial future. Gerber Life Insurance provides flexible and affordable solutions that cater to a wide range of needs. Whether you are a parent looking to secure your child’s future or an adult seeking guaranteed coverage, Gerber Life has a plan for you.

By understanding your options and comparing the different plans, you can make an informed decision and ensure peace of mind for yourself and your loved ones.